Decoding Kiyosaki: From Reading to Reality

As the calendar flipped to 2018, I found myself at a crossroads, seeking direction in the world of financial literacy. My guide? A book that has since become synonymous with wealth-building – Robert Kiyosaki’s “Rich Dad Poor Dad.” This wasn’t just a read; it was an awakening. As I delved into its pages, I realized I was embarking on a transformative journey from financial obscurity to becoming an astute real estate investor.

Charting My Course: The Book That Illuminated My Path

Take a step back with me. Picture a person who was a financial education enthusiast, thirsty for knowledge, eager to unlock the secrets of investing. I was that person, standing at the threshold of a vast financial universe, wondering where to commence. My guiding star emerged from the wisdom woven into Kiyosaki’s narrative, where he demystified his famed four quadrants and the deep-seated principles they embodied.

Delving Deeper into Kiyosaki’s Four Quadrants

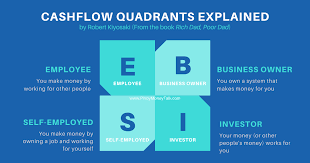

At the heart of “Rich Dad Poor Dad” lies a compass to navigate the diverse forms of income generation. Robert Kiyosaki, with a stroke of genius, lays out these pathways in the form of four distinct quadrants. Let’s venture deeper into each, unpacking their traits and the mindsets they breed.

E – Employee:

- Traits:

- Stability Over Risk: Prefers a steady paycheck and shies away from entrepreneurial risks.

- Routine-Oriented: Adheres to a structured work environment, typically 9-5.

- Mindset:

- Security Seeker: Places immense value on job security, benefits, and promotions.

- Externally Motivated: Looks to superiors for validation and direction.

S – Self-Employed:

- Traits:

- Lone Ranger: Often finds it challenging to delegate, believing no one can do the job as well as they can.

- Direct Effort-Outcome Link: Their income is directly proportional to the effort they put in.

- Mindset:

- Freedom Seeker: Desires control over their time and work but may inadvertently create a job for themselves rather than a business.

- Skill Reliant: Their earnings are often contingent on their unique skills or services.

B – Business Owner:

- Traits:

- System Builder: Recognizes the importance of systems and processes, ensuring the business can run without their constant intervention.

- Team Builder: Harnesses the strengths of a team, leveraging talents to grow the business.

- Mindset:

- Wealth Builder: Focuses on assets and structures that yield residual income.

- Big Picture Thinker: Looks beyond daily operations, strategizing for long-term growth and sustainability.

I – Investor:

- Traits:

- Financial Acumen: Possesses the knowledge to make money work for them, whether in stocks, real estate, or other investment avenues.

- Risk Taker: Not averse to calculated risks if the returns justify the means.

- Mindset:

- Growth Seeker: Constantly on the lookout for opportunities to expand their financial portfolio.

- Education Hungry: Continually upgrades their financial intelligence, understanding that the investment realm is ever-evolving.

The Quadrant Transition: A Paradigm Shift

To traverse from the E and S quadrants to the B and I sections is no easy feat; it’s a complete overhaul of one’s mindset. This transition demands a metamorphosis from seeking security and direct control to embracing systems, delegation, and financial sagacity.

Question 1: As you reflect on these quadrants, do any resonate with where you are currently? Where do you aspire to be?

Real Estate: The Catalyst for Transformation

It wasn’t just about reading; it was about applying. And what better realm to test these waters than real estate? This tangible asset class, ripe with potential, became the playground for my newly acquired mindset. Investing in real estate wasn’t just a financial move; it was a statement. It took a lot of up front work and investment on my end reading and executing buying property and setting up vacation rental business. This decision started the journey of not only real estate investment but eventually, building real estate and moving over 25% of income into paper assets in the form of ETF’s. Starting my real estate journey was a declaration that I was ready to transition, to let my money work for me, to step confidently into the I-Quadrant.

Wrapping Up

From the pages of a book to the vast expanse of real estate, my journey has been nothing short of transformational. The four quadrants are more than mere classifications; they’re a compass, directing where you could be headed financially. If you haven’t all ready done so be sure to check out the book and start your financial knowledge journey.

The Next Chapter?

Inspired? Eager to delve deeper into Kiyosaki’s teachings or the world of real estate? Follow our journey, learn from our experiences, and craft your own success story. Connect with us on Facebook and Instagram.

Financial Disclaimer: This narrative is a recounting of personal experiences. Investment decisions should always be made after thorough research and consultation.

Leave a comment